We want to invest but don’t want to invest a huge sum in one go. We all have heard about Post Office RDs (recurring deposits) which is a similar way to invest. But the returns are not quite encouraging.

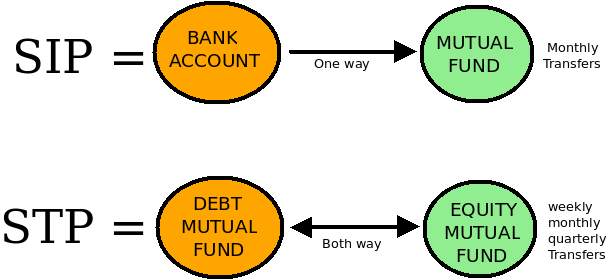

SIP is a solution to this problem which takes care of your wallet as well as gives you better returns as a reward for choosing this route of investment.

Lets understand in a simple language what is a SIP and a STP.

S.I.P (Systematic Investment Plan)

A SIP is a method where you can do monthly investment. An amount that you decide to invest gets debited automatically from your bank account at a date already decided by you. It’s a hassle free way of investment where you don’t have to bother about the date of investment and neither that small amount getting debited from your account every month hurts your pocket and household budget. But at the same time, it works on the principle of Rupee Cost Averaging and Power of Compounding which results in accumulation of a huge corpus for your Retirement or any goals in life for which you are investing .

All you need to do is give a mandate to the asset management company to deduct the investment from your bank account.

Let’s understand what do these heavy words – Rupee Cost Averaging & Power of Compounding mean with a simple example.

RUPEE COST AVERAGING

We all know markets are volatile and the fear of volatility makes investors sceptical about the best time to invest and they keep

trying to ‘time’ their entry into the market and it just goes on endlessly. Rupee-cost averaging allows you to opt out of the

guessing game and help you turning this volatility in your favor and benefit you overall.

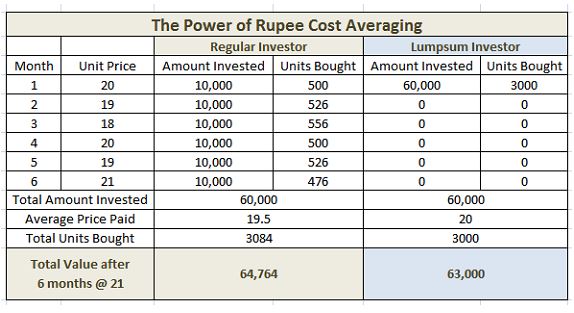

As can be seen in the table above, Rs. 10,000 invested over a period of 6 months at different price levels

accumulate more number of units in less price. But if money is invested in one go, fixed number of units are

alloted.

Also, the returns are more in case of investing through SIP by Rs. 1,764!!

Power of Compounding

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.”

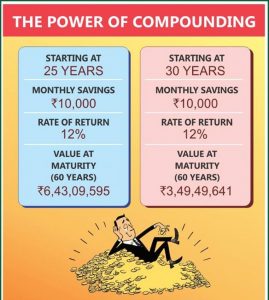

The rule for compounding is simple – the sooner you start investing, the more time your money has to grow.

As can be seen in the image on the left, just by investing 5 years earlier can DOUBLE YOUR MONEY!!!

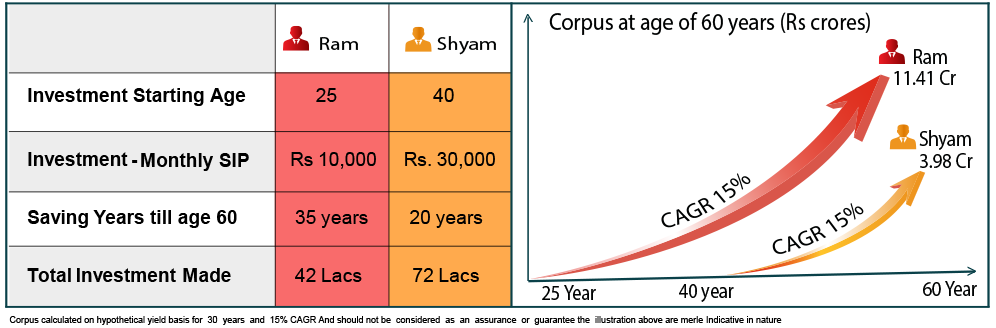

Ram invested Rs 10,000 for 35 years till his retirement at 60 years and accumulated a corpus of 11.41 CRORES.

While Shyam invested 3 times the amount (Rs 30,000) but only for 20 years and he could only accumulate 3.98 CRORES.

A gap of a whopping 7.43 CRORES!!!

THIS IS THE POWER OF COMPOUNDING!!

BENEFITS OF SIP

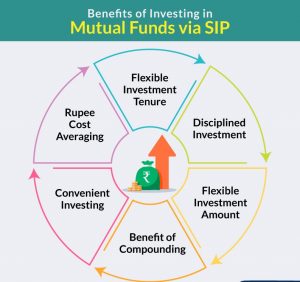

- SIP inculcates discipline to the investment behaviour.

- The SIP amount can be as low as you can imagine and as high as you want which helps you invest systematically every month.

- The SIP amount can be increased or decreased as per requirement giving the investors flexibility.

- Its the most convenient and organised way of investing and to see your money grow leaps and bounds in the long term.

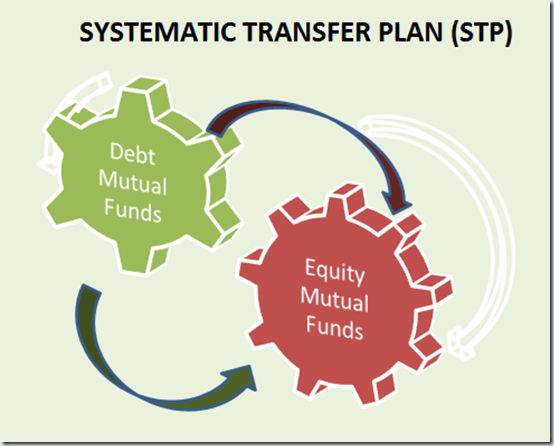

S.T.P ( Systematic Transfer Plan)

Many a times, we have surplus money lying idle in our

bank accounts which we do not need but don’t know

where to invest.

STP is a smart strategy to stagger your investment over a specific term to reduce risks and balance returns.

The idle money is invested into a liquid fund which gives

better returns than bank fixed deposits.

From there, STP is triggered into an Equity Mutual Fund on

a weekly basis.

STP gives dual benefit to the investors by giving dual returns :

one from Liquid Fund and the other from Equity Fund.

Both SIP and STP invest the money in a staggered manner and build an astounding corpus

with its magical tools – Rupee Cost Averaging & Compounding!

Benefits of STP

- STP generates higher returns as you initially invest in a debt fund which generates comparatively higher returns than a bank account.

- The returns you earn via STP are pretty reliable. This is because the amount in source fund (debt fund) generates interest until you transfer the entire amount so it’s a 2 way returns : one return generating from the liquid fund and other return getting generated from the equity fund where the money is being transferred.

- An STP can also be used to move from a risky asset class to a less risky asset class. For Example, in case of any goal planning like child education or retirement planning, once the goal is near, amount from equity fund can be transferred to a debt fund gradually so that the risk of losing money is negligible and the amount accumulated for the particular goal stays intact.

- Your portfolio should strike a balance between debt and equities. An STP re-balances the portfolio by moving investments from debt to equity funds or vice versa.